EU Sustainability Rules Overhauled: What the Omnibus Package Means for Your Business

In February 2025, the European Commission announced the Omnibus Package — a set of legislative changes aimed at simplifying existing sustainability rules and reducing administrative burdens. A key element of the package is the ‘Stop-the-clock’ Directive, which postpones the implementation dates for certain corporate sustainability reporting and due diligence requirements. The goal is to unlock €6 billion in administrative savings, streamline ESG reporting, and ease compliance — especially for small and medium-sized enterprises (SMEs).

But while the changes reduce complexity, they also raise important new questions around transparency, accountability, and progress toward net-zero — especially for sectors like food, where value chains are lengthy and fragmented.

Here’s what’s changed — and what it means for businesses today.

- Sustainability Reporting (CSRD & EU Taxonomy)

The Corporate Sustainability Reporting Directive (CSRD) which mandates companies to report on environmental, social, and governance (ESG) performance, has undergone major simplification:

Key Changes:

- Narrower Scope: Only large companies (1,000+ employees) are now required to report, removing ~80% of previous entities

- SME Relief: Smaller suppliers are no longer indirectly affected by their larger buyers’ reporting obligations.

- Streamlined Reporting: Reporting templates cut by 70%, reducing complexity and compliance time.

- Taxonomy Adjustments: Only the largest companies must report under the EU Taxonomy; others may report voluntarily. New financial materiality thresholds help focus disclosures

- Simplified “Do No Significant Harm” (DNSH) Criteria:

Starting with pollution and chemical use criteria across all sectors. - Timeline Delays: Reporting deadlines extended to 2028 for companies originally scheduled to report in 2026–2027.

What It Means:

For large companies, the reporting load is lighter — but it is still an essential directive. For SMEs, there’s less regulatory pressure, but that also means fewer incentives (or resources) to invest in sustainable practices. Retailers and food service providers may face new visibility gaps in supply chain emissions, particularly Scope 3 data.

- Sustainability Due Diligence (CSDDD)

The Corporate Sustainability Due Diligence Directive (CSDDD) which compels companies to monitor and mitigate human rights and environmental risks in their value chains, also sees significant adjustments:

Key Changes:

- Direct Partner Focus: Due diligence now centres on direct business relationships, reducing complexity.

- Less Frequent Monitoring: Reviews drop from annually to every five years.

- SME Protections: Large companies are restricted in how much information they can demand from smaller suppliers.

- Delayed Compliance: Requirements take effect from July 2028, with detailed guidelines expected by July 2026.

What It Means:

Companies gain time — and clarity — but risks remain. With delayed enforcement and limited supply chain coverage, there’s a reduced pressure to proactively address human rights, deforestation, or environmental harms in operations or sourcing.

- Carbon Border Adjustment Mechanism (CBAM)

The CBAM, the EU’s tool to price carbon on imported goods, is made more accessible

Key Changes:

- New Exemption Threshold: Importers of less than 50 tonnes per year are now exempt — covering ~90% of all importers (mostly SMEs) as they are representative of only ~1% of emissions.

- Simplified Reporting: Large importers face a lighter administrative load.

- Anti-Circumvention Measures: New rules aim to close current loopholes and prevent abuse.

- Future Expansion: More sectors and downstream goods will be added — with new legislative proposals expected in 2026

What It all means:

While smaller traders are spared, the carbon cost signal is clearer for major importers. For high-emission sectors, CBAM will increasingly shape procurement and supply chain decisions.

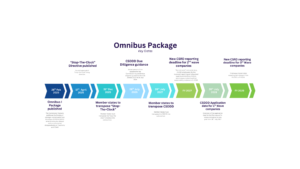

Revised Timeline

What’s at Stake?

The Omnibus Package marks a significant recalibration of the EU’s sustainability agenda — aiming to ease business burdens, but at a major cost:

- Reduced Supply Chain Transparency: With fewer suppliers reporting, companies may lose visibility on Scope 3 emissions.

- Weaker Incentives for SMEs: Without regulatory pressure, sustainability efforts across the value chain will almost certainly slow.

- Delayed Accountability: Delays in enforcement could slow progress on urgent ESG issues like deforestation and labour rights.

Bottom Line

The EU is easing the compliance burden — but not entirely walking back on sustainability goals. For large companies, expectations remain high. For SMEs, the pressure may lift — but so too might the momentum for change. SMEs should be aware of the likely material risks that arise due to slow transition. Businesses aiming to lead on sustainability will need to go beyond the minimum compliance, especially when data, transparency, and trust in value chains remain mission-critical.

Stay ahead of the curve -> Contact TrackCarbon to see how we can support your food sustainability data goals and transition plans.